Form 15g Download

- Form 15g Download Federal Bank

- Form 15g Download For Pf

- Form 15g Download Pdf In Hindi

- Form 15g Download Pdf For Epfo

- Form 15h Download Pdf

- Form 15g Download Epfo

- Form 15g Download Pdf For Pf In Hindi

Number to all the Form No. 15G received by him during a quarter of the financial year and report this reference number along with the particulars prescribed in rule 31A(4)(vii) of the Income-tax Rules, 1962 in the TDS statement furnished for the same quarter. In case the person has also received Form No.15H during the same quarter, please. Title: ITR01-18.p65 Author: testing Created Date: 10/8/2016 5:00:16 PM. PF Withdrawal Form – Download Form 19, 10C, 31, 15H, 16 & Others. Image provided below is a PF withdrawal form, but because it is.jpg file format it would be difficult to print, therefore don’t download it. Instead, you can download the form in.pdf file format that would be faster to print and proper way as well. In this article we are discussing important points to remember while submitting the Form 15G and Form 15H to the deductor. We have also included frequently asked questions and answers on Form 15G and Form 15H. Reader can download the latest Form 15G and Form 15H in Excel, Word and PDF format from the links given at the bottom of the article.

Form 15G & 15H is submitted to the banks to avoid the deduction of tax. Learn more on what is Form 15G & 15H and how to download them online at Moneycontrol.

If you invest in certain instruments like bank fixed deposit, recurring deposit and corporate deposit, the interest you earn is taxed. Banks and post offices will deduct TDS (Tax deducted at source) if your interest income exceeds Rs 10,000 in a financial year. If you are a senior citizen, this limit is Rs 50,000 a year. Bank deducts TDS on your interest, even if your total income is not taxable. If you submit Form 15G (for those less than 60 years of age) and 15H (for those above 60 years) to the bank requesting them not to deduct TDS, then TDS will not be deducted. Some banks will let you submit these forms from the website of the bank. Form 15G and 15H are valid for one financial year. So, it is important to submit these forms at the beginning of the financial year so that no TDS is deducted on your interest.

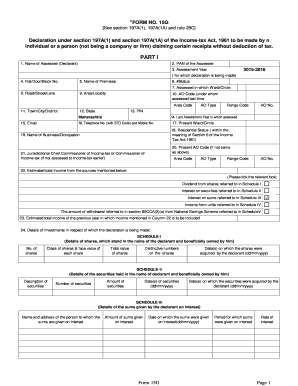

15G See section 197A(1), 197A(1A) and rule 29C Declaration under section 197A (1) and section 197A(1A) to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax. Name of Assessee (Declarant) 2. PAN of the Assessee1. Download: 15: Form 15G: To avoid Tax when you are withdrawing more than 50000 Rs of PF amount in less than 5 yrs of service. Download: 16: Form 15H: To avoid TDS in case of senior citizens. Downlo ad: About PF Form 19. PF form 19 is used to withdraw PF contributions of employee and employer(12% of employee & 3.67% of the employer).

How to download form 15G

You can visit the Income Tax Department’s website: www.incometaxindia.gov.in, go to ‘Income Tax Forms’ under the ‘Download’ section and download form 15G online either in PDF or in a form version that can be filled. Form 15G is also available on the websites of banks, or you can also collect it from bank branches.

Do keep in mind that you have to submit separate Form 15G for deposits you have with each bank brank or post office to reduce your TDS burden.

Once the form is downloaded, you should print it, fill it up correctly and submit it with the appropriate bank or Post Office to reduce your TDS burden. Banks will also let you submit it online.

related news

Simply Save podcast Want to know the secrets of value investing?

MasterCard: All about MasterCard Debit Card in India

Advantages and disadvantages of having a debit card

Form 15G Sample

Here is the format of part 1 of from 15G that you can download for the Income Tax Department’s website.

PART I| 1. Name of Assessee (Declarant) | 2. PAN of the Assessee1 | ||||||||||

| 3. Status2 | 4. The previous year(P.Y.)3 (for which declaration is being made) | 5. Residential Status4 | |||||||||

| 6. Flat/Door/Block No. | 7. Name of Premises | 8. Road/Street/Lane | 9. Area/Locality | ||||||||

| 10. Town/City/District | 11. State | 12. PIN | 13. Email | ||||||||

| 14. Telephone No. (with STD Code) and Mobile No. | 15 (a) Whether assessed to tax under the Yes No Free magic ball game download. If your aim is good, then you will return a hero! Income-tax Act, 19615: (h) If yes, the latest assessment year for which assessed | ||||||||||

| 16. Estimated income for which this declaration is made | 17. Estimated total income of the P.Y. in which income mentioned in column 16 to be included6 | ||||||||||

| 18. Details of Form No. 15G other than this form filed during the previous year, if any7 | |||||||||||

| Total No. of Form No. 15G filed | The aggregate amount of income for which Form No.15G filed | ||||||||||

| 19. Details of income for which the declaration is filed | |||||||||||

| Sl. No. | Identification number of relevant investment/account, etc.8 | Nature of income | Section under which tax is deductible | Amount of income | |||||||

................................

Signature of the Declarant

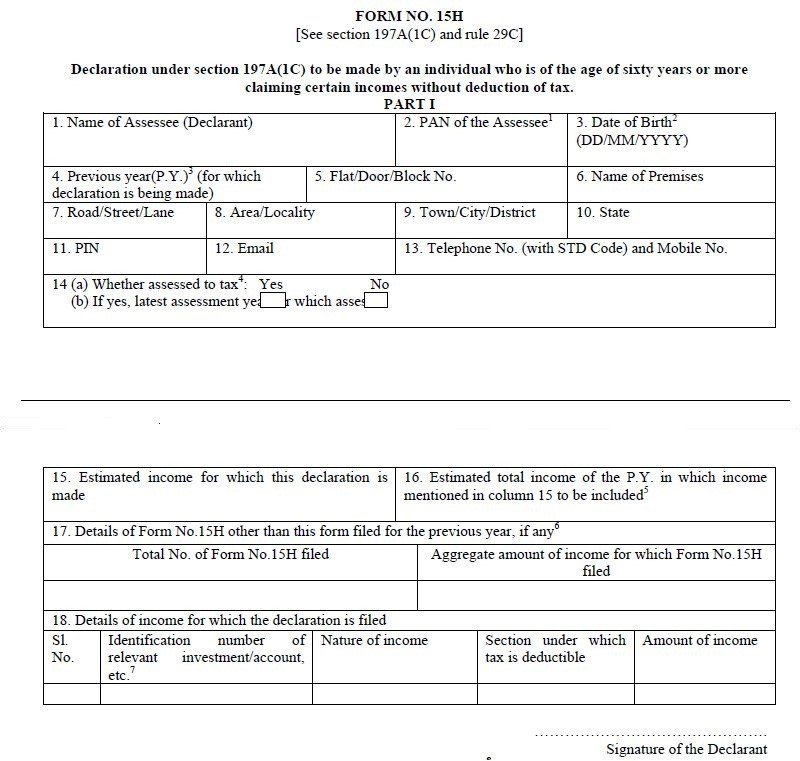

How to download Form 15H

Now we will take you through the form 15H download process. You can visit the Income Tax Department’s website: www.incometaxindia.gov.in, go to ‘Income Tax Forms’ under the ‘Download’ section and download form 15H either in PDF or in a form version that can be filled. Form 15H is also available on the websites of banks or you can also collect it from bank branches.

Do keep in mind that you have to submit separate Form 15H for deposits you have with each bank branch or post office to reduce your TDS burden.

Once the form is downloaded, you should print it, fill it up correctly and submit it with the appropriate bank or Post Office to reduce your TDS burden. You can also submit it online through the bank’s website.

Form 15H sample

Here is the sample of Part 1 of form 15H that you can find on the Income Tax Department’s website.

PART I

| 1. Name of Assessee (Declarant) | 2. PAN of the Assessee | 3. Date of Birth2 (DD/MM/YYYY) | ||||||

| 4. The previous year(P.Y.)3 (for which declaration is being made) | 5. Flat/Door/Block No. | 6. Name of Premises | ||||||

| 7. Road/Street/Lane | 8. Area/Local | 9. Town/City/District | 10. State | |||||

| 11. PIN | 12. Email | 13. Telephone No. (with STD Code) and Mobile No. | ||||||

14 (a) Whether assessed to tax4: Yes No (h) If yes, the latest assessment year for which assessed | ||||||||

| 15. Estimated income for which this declaration is made | 16. Estimated total income of the P.Y. in which income mentioned in column 15 to be included5 | |||||||

| 17. Details of Form No.15H other than this form filed for the previous year, if any6 | ||||||||

| Total No. of Form No.15H filed | The aggregate amount of income for which Form No.15H filed | |||||||

| 18. Details of income for which the declaration is filed | ||||||||

| Sl. No. | Identification number of relevant investment/account, etc.7 | Nature of income | Section under which tax is deductible | Amount of income | ||||

................................

Signature of the Declarant

Key features of from 15G

Form 15G applies to you if you are below the age of 60 and have invested in some fixed income products and expect to receive interest income exceeding Rs 10,000 in a financial year.

Form 15G can be submitted to the bank to prevent TDS deducted on your interest income if your total taxable income is less than Rs 2,50,000.

To be eligible to submit Form 15G you must also be a resident Indian. Form 15G should be submitted during the beginning of the financial year.

The structure of Form 15G underwent substantial change in 2015 to make it easier for the taxpayer.

Key Features of 15H

Form 15H applies to you if you are above the age of 60 and have invested in some fixed income products and expect to receive interest income exceeding Rs 50,000 in a financial year.

You should submit Form 15G to the bank to avoid TDS deducted on your interest income if your total taxable income is less than Rs 3,00,000. For super senior citizens, the limit is Rs 5,00,000.

To be eligible to submit Form 15H you must also be a resident Indian. Form 15H should be submitted during the beginning of the financial year.

The structure of Form 15H underwent substantial change in 2015 to make it easier for the taxpayer.FAQs

Am I eligible for submitting form 15G/15H?

You should submit Form 15G/15H only when your income is below the threshold limit and hence exempt from tax.Form 15g Download Federal Bank

When will TDS be deducted on my interest income?

Form 15g Download For Pf

TDS is deducted on interest income when the interest income for a taxpayer exceeds Rs 10,00 in a financial year. In case of senior citizens, the limit is Rs 50,000.Form 15g Download Pdf In Hindi

Is there any due date for submitting form 15G/15H?

Form 15g Download Pdf For Epfo

While there is no due date as such, it is recommended that one submits the form at the beginning of the financial year or when someone starts a new deposit.How long will it take to for the service request to be accepted after I submit the form?

If you submit the request online, it happens on a real-time basis. If you submit it manually at a bank or post office, it will take a day.Form 15h Download Pdf

What if I do not submit Form 15G/H and the TDS is deducted by the bank?

If you have not submitted Form 15G/H and the bank deducts TDS, you can claim a refund on excess TDS deducted by filing your Income Tax Returns, since the bank deposits TDS with the Income Tax Department.Form 15g Download Epfo

You can now invest in mutual funds with moneycontrol. Download moneycontrol transact app. A dedicated app to explore, research and buy mutual funds.